Welcome to I-PAY

Providing UK payroll services since 1997

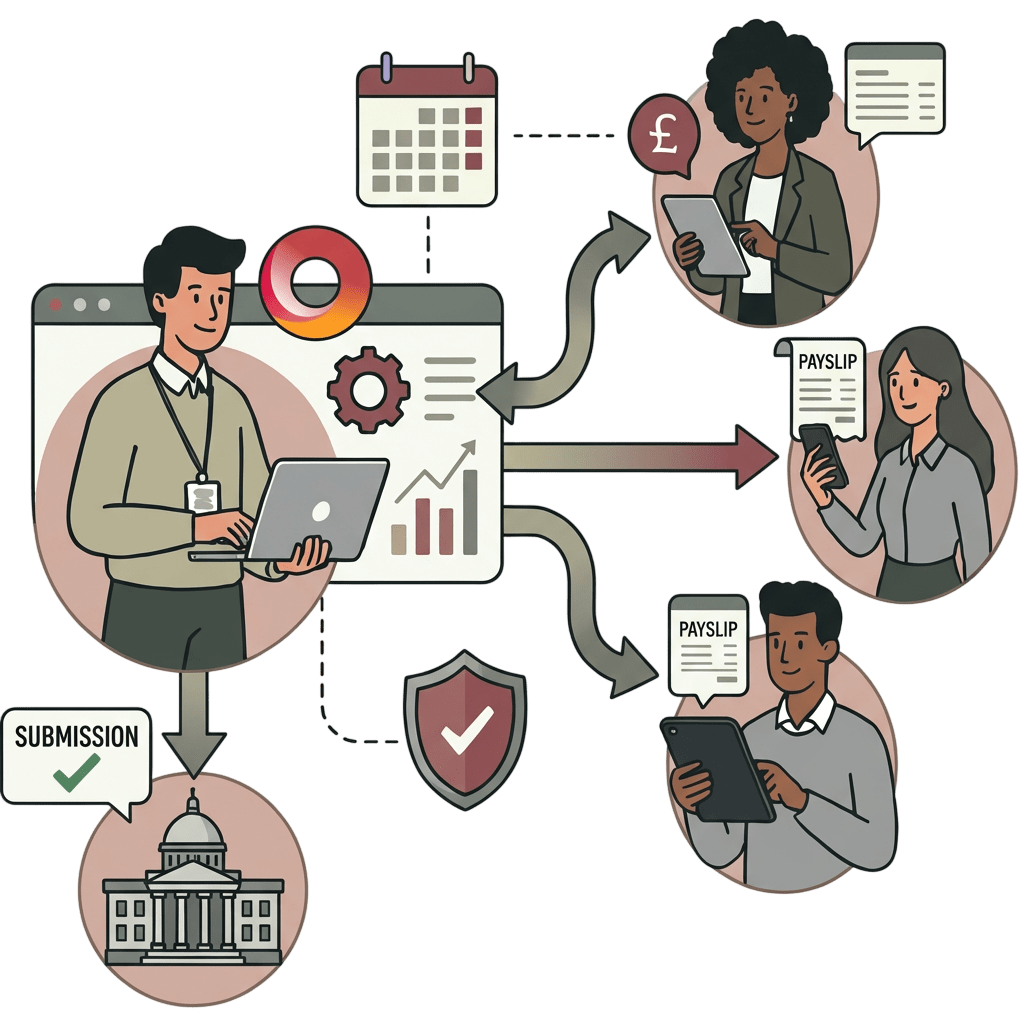

We combine the convenience of an online service with all the support of a dedicated account manager. Trusted by businesses across the UK for accurate, reliable payroll processing, HMRC compliance, and seamless pension administration.

About Us

We have been providing accurate, reliable and trusted payroll services for over 28 years

I-PAY provides a complete payroll solution along with expert support and a personal touch. With employer and employee portals, bank import files and popular accounts and pension integration we can simplify your complete payroll process.

HMRC Compliant

Your payroll processed using HMRC recognised software

Managed Payroll

Your payroll supported by a dedicated account manager

Real Time Information

Submissions are made for you on time, avoiding penalties

Auto Enrolment

Assessments and correspondence to comply with pension regulations

Features

I-PAY combines all the convenience of an online service with all the support of a managed service. This means you can administer your payroll online at any time, from submitting starters to reviewing the month's payslips. Behind the scenes we process your payroll for you, providing you with the benefit and support of 28+ years experience.

Monthly Processing

Working to your regular schedule we process within 1-2 working days leaving time for checks and revisions

Pensions

We assess your payroll every period for auto enrolment, operate postponement and send correspondence

Pension Files

Direct pension submission to NEST and import files for main providers such as Aviva, Scottish Widows and more

Benefits in Kind

P11D BIKs & expenses are reported annually, with Class 1A NICs calculated. Employee P11D copies available in the portal

Employee Portal

A secure site for employees to access current and historic PDF payslips, P60s, P11Ds and P45s

Employer Portal

A secure site for you to check and approve draft payslips, add starters and view your billing history

Pricing

Tailored to Your Business

Our pricing is bespoke to each client's requirements. We take into account several factors to provide you with a competitive quote.

- Number of employees

- Payment frequency

- Complexity

- Additional services

Request a Quote

Complete the form with as much information as possible about your payroll. We'll get back to you within 1 working day with your personalised quote or follow-up questions

Frequently Asked Questions

1. What's included in your managed payroll service?

By outsourcing your payroll processing to I-PAY you will benefit from timely processing within agreed deadlines, comprehensive reports, bank files, RTI submissions, employer portal for checking and approving payslips, employee portal for secure access to payslips, P60s, P11Ds and P45s - cutting down on copy requests. Telephone and email support are provided for when you have any questions. I-PAY integrates with popular accounting software and pension providers to save you even more time.

2. How much does I-PAY cost?

Please complete the quote form above and we will get back to you within 1 working day. Every payroll has different requirements and we will offer a competitive package for your sized payroll.

3. I am a new employer. Can you help me set up a PAYE scheme?

We can point you in the right direction to get registered as a new employer with HMRC online, and as soon as you receive your Employer's Reference we can register as your PAYE Agent and set up your payroll.

4. I am using another payroll service or doing the payroll myself. When can I migrate to I-PAY?

Your payroll can be migrated any time using employee records and year-to-date payroll figures from your current system. Please speak to us about the system you use and size of payroll and we can provide assistance with exporting the information required.

5. How secure is my data?

We only use UK GDPR compliant software and cloud services. Portal documents are protected with AWS Dual-Layer Server-Side Encryption and are stored in a UK data centre. Our website uses SSL encryption for delivering data and reports through the employee and employer portals.

Questions ?

If you have any other questions about out services please send a message and we'll get back to you.

Send a Message

Testimonials

Our clients come from diverse industry sectors across the UK and beyond. We also work with international companies to support their UK payroll operations, providing expert knowledge of local legislation and compliance requirements.

Contact

Address

(Correspondence only)

Apartment 12 The Kiln

Sotherington Lane, Selborne

Hampshire, GU34 3LP

Call Us

01428 788155

0845 4745 105 (lo-call rate)

Email Us

mail [at] i-pay.co.uk

Open Hours

Monday - Friday

9:00AM - 05:00PM